This page provides two simple tools to help you estimate and plan your land financing. Our standard Land Loan Calculator shows your monthly payments, total interest, and total repayment based on the loan amount, interest rate, and repayment term. If you need a more detailed breakdown, the LTV-Based Land Loan Calculator uses the land’s market value and your chosen loan-to-value (LTV) ratio to calculate the loan amount, down payment, monthly payments, and total interest. Both tools are easy to use, accurate, and based on the standard loan amortization formula, giving you clear, reliable numbers before purchasing land.

Note:If you don’t understand the terms used on the Land Loan Calculator, please see the section Important Financial Terms Used and Understanding the Results.

Land Loan Calculator ⭣

LTV-Based Land Loan Calculator ⭣

What is a Land Loan?

Land loan (or lot loans) is a kind of loan that aims financing a piece of land. This type of loan concentrates on buying the whole land, unlike the traditional mortgages that often include a home. The amount you can borrow is determined by the value of the property (land). Also, interest rate and the principal are paid back over a certain period of time. Your loan interest rate and principal amount depend on the type of land you are willing to buy. Below you will have the types of land, all the descriptions about them and financing difficulties related to loan.

Types of Land Loans

Raw Land Loan

Raw land is a piece of land that is untouched or developed. This type of land can be forests, area with little development or a land in their natural state. Generally raw land is less expensive than the other types, but they are more difficult for getting finances. Usually, their requirements like down payment and interest rate are higher due to the higher risk.

Unimproved land loans

This type of land may have some conditions better than raw land, but still is undeveloped. Unimproved land may have lack of infrastructure such as roads, water lines, electricity or other utilities. There is a chance that some of the things mentioned can be available. Related to loans, unimproved land have easier financing requirements compared to raw land. Conditions are usually a little better, but can still can be challenging.

Improved land loans

Improved land compared to raw and unimproved land is the most preferable type of land for a buyer. This type of land may include features like roads, buildings and other utilities because of the development state they may be. Loans of improved land usually have the most beneficial terms compared to the other land loans. While this type of land haves the highest price, financing them and the required terms are a lot easier.

How Do Land Loans Work?

With land loan you are able to buy a property without having the need to start working right way. Compared to typical mortgages that include both land and the property, land loan primarily focuses only on purchasing the land. When the type of loan you applied is approved, lenders will finance you and along with that you will pay back them in time period including the interests. On the other hand, having the right qualifications for land loan is difficult and complicated. Below you have some of the requirements to land loan for more details you have to contact the lenders:

- Strong credit score

- Explain in great detail the plans for land use

- Down payments

- Repayment Terms

How a Land Loan Calculator Works and How to Use it?

Our site have done the Land Loan Calculator to help you in calculating the financial impact of purchasing land. This tool enables you to make the accurate decisions related to financing and affordability. We provide an estimation of the total amount plus the interests, monthly payment and the total interests. We have provided a standard Land Loan Calculator and LTV-Based Land Loan Calculator to meet your needs, because you can make errors and feel overwhelmed over a period of time when calculating them. Below you will have some of the benefits.

Benefits of Using a Land Loan Calculator

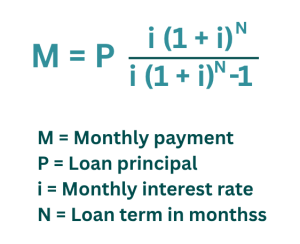

Our tools area based on the Loan Amortization Formula so all the input fields are required to make an accurate loan calculation. This formula is used also in other loan calculations so basically you can use them also for other calculations. Below you have an image of the formula and describing all the components of it and the benefits of using our tools.

- Quick Estimation: Instantly shows repayment details.

- Better Financial Planning: Helps assess affordability.

- Loan Comparison: Compare offers from different lenders.

- Informed Decisions: Understand long-term obligations.

Important Inputs for the Calculators

The list of key inputs is also the step-by-step guide before clicking the Calculate Land Loan button. Your only job is to input all the info to the designated fields and for the rest we cover you up with calculations for each tool. The Land Loan Calculator has 3 input fields and the LTV-Based has 4 inputs. Annual Interest Rate and Repayment Term are included to both calculators. On the other hand, Loan Amount field is only included the Land Loan Calculator and LTV (Loan to Value) and Land Value only to LTV-Based Land Loan Calculator.

Important Financial Terms Used in the Loan Calculators

- Loan Amount: The total amount borrowed.

- Annual Interest Rate: Annual interest charged by the lender.

- Repayment Term: Duration over which the loan will be repaid.

- Land Value: The market price of the land you intend to purchase.

- LTV (Loan-to-Value): The percentage of the land’s value that you want to borrow.

Understanding the Results of the Calculators

The Loan Amount and Down Payment are calculations done only by LTV-Based Land Loan Calculator and the other outputs are the same for both of them.

- Loan Amount: The total sum borrowed from the lender.

- Down Payment: Initial payment made by the borrower.

- Monthly Payment: The fixed amount paid every month toward the loan.

- Total Amount (+ Interest): The complete amount repaid, including both principal and interest.

- Total Interest: The extra cost paid to the lender for borrowing the money.

Frequently Asked Questions (FAQs)

1. What does this land loan calculator do?

It helps you estimate your monthly payments and the total cost of buying land, so you can plan your budget easily.

2. What do I need to use the calculator?

Just enter the land price, how much you want to put down, the interest rate, and how many years you want the loan to last.

3. Are the results exact offers from a lender?

No. They’re an estimate based on the information you enter. Your actual offer will depend on your credit, the land’s value, and the lender’s full review.

4. How are land loans different from normal home loans?

5. What is the Loan-to-Value (LTV) ratio?

It’s a percentage that compares how much you want to borrow to the land’s actual value.

6. Why does the LTV ratio matter?

A lower LTV helps you get better interest rates, higher approval chances, a safer loan amount, and sometimes avoids extra costs like mortgage insurance.

7. What is considered a “good” LTV?

Around 80% or lower. The lower it is, the less risky your loan looks to lenders.

8. How does my down payment affect the LTV?

Bigger down payment = lower LTV = better loan terms. Simple as that.

9. Do all lenders use the same LTV rules?

No. Each lender has its own limits and requirements, depending on the type of land and the market.

10. How is the LTV ratio calculated for a land loan?

It’s calculated by dividing the loan amount by the land’s appraised value, then multiplying by 100.

For example: if the land is worth $100,000 and you borrow $80,000, your LTV is 80%.

Explore More of Our Tools

Discover additional calculators that can help you with a variety of everyday tasks and calculations. These calculators are designed to help you solve a wide range of everyday problems quickly and accurately. Our site offers a variety of helpful calculators designed to make your life easier. Click on any of the tools below to explore related calculators and discover more ways to quickly perform everyday calculations.

Construction Loan Calculator →

Quickly estimate your construction loan payments and total project financing costs.

Area Units Converter →

Easily convert between different area measurements like square feet, square meters, acres, end more.

Asphalt Calculator →

This tools helps to calculate the amount of asphalt costs and tons needed .